Sign up below to get Unqualified Opinions delivered to your inbox.

You’re Not Obsolete

Emily texted me the other day and said “Your next Unqualified Opinion should be about how just because you say something doesn’t make it true.” Her beef was with an email we had received from someone who was clearly integral to the success of her business saying that she wasn’t integral to the success of her business because all she did was drive strategy (which only happened a few times a year), review the financials and set goals (which only happened monthly), and collect overdue AR (which only happened weekly).

So not integral!

The statement is absurd on its face, but the reasoning was that none of these activities happened daily and therefore were not critical to day-to-day operations. And while it’s true that none of these things happened daily, that reasoning ignored the fact that these more intermittent activities are what enabled critical daily activities to occur.

When we pointed that out, we were met with frustration. This was not only because we were disagreeing (on the merits!), but also because I think us pointing that out forced this person to come to terms with the fact that she had not achieved an important goal of hers, which was to have made herself obsolete.

Look, we should all be endeavoring to make ourselves obsolete. Our jobs, our families, and the world will one day have to move on without us and we should do what we can while we are present to make sure that that inevitable transition is as seamless as possible.

Yet even if you recognize that and work hard to achieve it, a true fact is that unless you are entirely absent, you are never as obsolete as you might tell others or lead yourself to believe. Case in point, we invested in a business where a clear succession plan was in place and there was universal agreement that the number two was ready to take over. Then the CEO was diagnosed with cancer. A few days later he went into the hospital and never came out.

While the business at that moment was the least of our concerns, when we and everyone else got back to focusing on the business, we believed it to be in good hands. Many moons later, and only after the numbers had worsened, we figured out that while the business was in caring hands, it wasn’t necessarily in adept hands. By losing that CEO, we had lost an important driver of quality control. In other words, even though the CEO wasn’t necessarily doing much, he was, by virtue of sitting in his seat and having the potential to do something, causing others to work smarter and make better decisions.

I told this story to the “not integral” woman we were talking to and also said “Hey, look, this may be my own problem that I have scar tissue.”

But!

Scars are scars for a reason, and you should never want to or do something again that gave you one. She looked like she agreed, but didn’t, but also did, but also didn’t want to admit it. The resolution is that we’d both think about it and revert.

The heartwarming side of this story is that as long as you’re around, you’re at least not obsolete and probably more likely incredibly important. The more frustrating flip side is that you and others, even if you’re being intellectually honest, probably don’t fully appreciate that.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

What You Think is Worth Reading

After I made my recent book recommendations, I had more than a few people (since I asked you to) send in their own. Thank you! I’m always on the lookout for new tomes and now I have some things to take to the beach with me this summer. In case you’re also deciding what to read next, here’s what some others are recommending (with some reasons why)…

Jon: Thinking in Bets by Annie Duke

“Thinking of decisions in terms of bets and odds has been a very useful framework for me, and the book has a lot of overlap with concepts like Bayes and position sizing.”

Justin: Calculated Risks by Gerd Gigerenzer

“The book really helps with the logic (with great visuals) on how to think about Bayes’ theorem, base rates, and how to update. A good read for investing, but more importantly a great book to help you think about the numbers you see in life.”

Joe: Liar’s Poker by Michael Lewis

“Guys in suits often aren’t as knowledgeable and/or smart as they appear.”

Johnny: Boss Life by Paul Downs

“Nothing gave me a better appreciation of the daily battle that is SMB ownership.”

Matt: Great Mental Models by Shane Parrish

“Improving the way one thinks is likely the best compounding investment anyone could ever make.”

Emily: Glass House: The 1% Economy and the Shattering of the All-American Town

“The author draws some pretty extreme conclusions (basically blaming private equity transactions for the opioid epidemic in Ohio), but his research on the actual cycle of deals is thorough and well told. This book will probably never leave my mind.”

Michael: Capital Returns by Edward Chancellor

“The boom and bust told through the investor letters of Marathon Capital.”

Milo: Investing: The Last Liberal Art by Robert Hagstrom

“Big ideas in multidisciplinary domains with parallels to investing.”

Mark: The Psychology of Judgment and Decision Making by Scott Plous

“A highly concentrated walkthrough of the biases that drive our everyday decision-making and how we can fight against them.”

Oh, and a lot of people think you should read The Psychology of Money by some Morgan Housel guy. Whatever. Have a great weekend.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Mushrooms!

We’re in the midst of mushroom hunting season here in mid-Missouri, which means that the crazy guy with the knife wearing the Capital Camp hat (May 21!) walking slowly through the woods out by the river at six in the morning is me. Mushroom hunting wasn’t anything I’d done before we moved to mid-Missouri, but I picked it up as a hobby as part of the whole “if we were going to move to Missouri, we were going to move to Missouri” thing. Plus, one of our neighbors was pretty sure I could never find as many as he does and, well, I do still have a bit of a competitive streak in me.

Anyway, Holly, after stumbling across a cryptic post on my X nee Twitter page, asked me about hunting mushrooms the other day and how I did it. Suffice it to say that there isn’t a lot you can learn from others about hunting mushrooms. That’s because people are secretive about their spots and techniques since the season is short, supply is limited, and the little guys are both valuable and delicious. My aforementioned neighbor, for example, after challenging me, had no interest in showing me the ropes (and I don’t blame him).

So five years ago I googled the basics and then spent a lot of hours walking slowly through the woods near my house finding very few (14 to be exact…I have a spreadsheet).

Fast-forward to today and I found many more than that in my first hour of hunting this season. Why? Because now I know where to look!

See, morels have a tendency to spring up in the same areas as they have in the past. Not always, of course, but your probability of finding one is much higher if you are looking in a place where you found one before than if you’re looking in a place where you haven’t. And every year I’ve looked, I’ve found at least one new place to look, which means that five years into the hobby I now have more than a few “spots” (shoutout compounding).

Because every time I go out, I don’t just go to the spots I know will yield. Instead, I also set aside at least 30 minutes (depending on how much time I have) to look in spots I’ve never looked in before, in spots I’ve looked in before because they seem like they should be promising from a moisture/soil/sun/leaf cover perspective, but that haven’t previously yielded anything, and in spots where I may have once seen a crazy person slowly walking through the woods in April. The reason being “just in case” and also because I always want to be adding to my spots in case one of my spots goes away (which happened a few years ago when a particularly good one flooded over).

And when I explained this, someone who was listening in (I can’t remember who) said, “Aha! 20% time!”

If you don’t recall, 20% Time is Google’s (perhaps apocryphal) policy that full-time Googlers spend 20% of their day doing something that isn’t proven, but is instead high potential. To apply this to small business, I previously recommended to “Keep a list of everything your business might do to grow…but force rank them based on potential and only tackle one or two at a time” and to “watch competitors…like a hawk and be shameless about trying things they are doing that might be working.”

All of this is to say that I was subconsciously treating my hobby like it was one of our businesses, and when I realized that, I realized I might be a little sick.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

The White Paper Work Continues

Diversification can get a bad rap in the investing community as “diworsification,” which is to say that if you are spreading your bets too thin, you’re not mathematically making any bets at all. Of course, a mitigating factor here when applying this framework to small, private companies is that these companies tend to be volatile and, as I’ve said before, can be at all times a few consecutive bad months away from a crisis. What that means is that if you are trying to build a compelling long-term return stream in our space, you need to be cognizant of aggregating highly disparate assets. Further, your odds of diworsifying among small, private companies is difficult because you can’t practically go out and acquire 100 or more all at once like you can in the public market, so the risk to be aware of is concentration, particularly if it’s inadvertent.

And that’s the twist re: diversification among small, private companies. Ones that look different can actually be quite similar and ones that look similar can actually behave very differently. So what makes a small, private company a disparate asset?

When it comes to public companies, for example, accepted vectors for diversity include size (even though almost all public companies in the overall scheme of things would be considered pretty big), industry, geography, and growth profile/valuation. Among small private companies, however, size doesn’t really apply, since none are big enough to not be fragile and nor, for the most part, does growth profile/valuation. That’s because valuations tend to cluster around the average and also because, as we like to stay around these parts, no business stays small on purpose, so the growth of any mature small business is definitionally being blocked by something.

That leaves industry and geography, which both apply and should often be considered in tandem, though on a more refined scale (e.g., it’s not US versus EMEA, but the Sun Belt versus the Northeast). For example, a pool company in Arizona makes a lot less margin on service than one in the Northeast because in geographies where it freezes and thaws, there is more price insensitive seasonal pool opening and closing revenue. And a fence company in a geography with soft soil will have better economics than one operating in rocky soil because of the throughput on putting up posts.

So if you’re building a portfolio of small, private business, here are some other vectors to consider:

Seasonality: A fireworks distributor will generate a much more reliable stream of cash flows when paired with a Christmas ornament manufacturer than it will with a pool toys manufacturer.

Business model: A service company that gets paid upfront will generate a much more reliable stream of cash flows than a construction business that has to try to collect 20% retainage.

Weather: We didn’t realize until it happened how much a rainy month in the Southwest would impact our pool, fence, and waterproofing businesses all at the same time.

Deal structure: If all of your deals have earnouts, it might be a long-time before you generate a reliable stream of cash flows, so if you do a deal with an earnout, you might complement it with a deal that includes a preferred return.

People: Your portfolio is significantly riskier if all of your operators want to retire within three years than if they don’t.

The point is that if you’re building a portfolio of small, private businesses then you’ll want to be as highly diversified as you can be, but also that what makes for diversification in this space can be incredibly idiosyncratic. So be aware of what your exposures are and aren’t with the goal of turning inevitable individual business volatility into a more reliable blended return stream.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Space Junk

One of the craziest stories I’ve been following recently awaiting resolution was that of the Florida man whose house got bombed by NASA. Because way back in March 2021 the International Space Station decided to throw out 5,800 pounds of old batteries, expecting them to burn up in Earth’s atmosphere and disappear forever. But 1.6 pounds sneaked through, blowing a hole in Alejandro Otero’s roof in March 2024 and crashing through two floors while almost decapitating his son.

Whoops.

Commenting on the fact that the rocket scientists didn’t quite get the math right on this one, NASA wrote:

The International Space Station will perform a detailed investigation of the jettison and re-entry analysis to determine the cause of the debris survival and to update modeling and analysis, as needed. NASA specialists use engineering models to estimate how objects heat up and break apart during atmospheric re-entry. These models require detailed input parameters and are regularly updated when debris is found to have survived atmospheric re-entry to the ground.

NASA remains committed to responsibly operating in low Earth orbit, and mitigating as much risk as possible to protect people of Earth when space hardware must be released.

Comforting, no?

I wrote a while back about the spreadsheet that presumably exists somewhere where if you change the value of one cell (the one that calculates estimated future viewing patterns of Netflix content and therefore the rate at which the cost of that content is amortized), you could double Netflix’s profit or cut it in half. Well, apparently there’s also a spreadsheet somewhere where if you change the value of one cell (the one that calculates how much various metals heat up and break apart during re-entry), it might get us all annihilated by falling space debris.

All things considered, Mr. Otero seems to have dealt with this manifestation of what I call “Are you effing kidding me?!” risk in a remarkably calm manner. He’s waited for NASA to confirm its findings and is asking them to “resolve the damages” (though I have no idea what court has jurisdiction over space releases and/or whether or not anyone could prove that NASA was negligent here). But if they don’t “resolve the damages,” well, are you effing kidding me?

Here are the takeaways:

Risky actions can take a long time to materialize into tangible consequences. While federal law may have a 5-year statute of limitations, the real world can punish you whenever it wants, so reserve accordingly.

Exogenous factors outside of our control are conspiring against us all the time, even up in low Earth orbit. You may not have time to worry about space junk, but you need to be prepared for space junk.

Oh, and your model is probably wrong.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Hair Is Opportunity

We have a joke around the office that we’re in the business of shaving hair. This is in recognition of the fact that small- and medium-sized businesses (SMBs) often come with lots of hair on them in many forms. That can include sloppy accounting, unresolved personnel matters, customer and/or supplier concentration, and even compliance with laws and regulations that is, shall we say, in the gray area. And of course this hair is what can make a business hard to transfer and even uninvestable.

But!

One way to create significant value is to remediate these issues over time i.e., shave the hair. That’s because in doing so, while you might or might not improve the performance of the business, you’re making it more investable. That increases the size of the pool of potential future buyers, making the business more valuable.

In other words, the less hair, the higher the multiple.

To wit, we saw a business recently that had botched an acquisition a few years ago and in the course of trying to integrate it had lost and was still losing quite a bit of money. Further, it had been through several rounds of layoffs, revalued inventory, written off assets, and recategorized expenses. The numbers were a mess.

That’s hair.

And while it’s normally not a good thing to lose money with that much hair, what was oddly impressive about this situation was that the core business had been able to fund those losses for so long. What that meant is that the core business might actually be a good one. Or, at the very least, that it could afford to pay for its shave.

So I said to Holly, “Hey, let’s reach out and see what the story is here. While we’d normally not be interested in a business with so much hair, this hair seems shave-able. And if we can shave the hair, we should do okay.” And Holly, after giving me a funny look, agreed.

The key to shaving hair, though, is not just knowing what the hair is, but also figuring out ahead of time that you can shave it. And there are two keys to that:

The business is generating enough cash to self-finance its shave.

The people at the business won’t resist or sabotage being shaved.

But if either one of those things isn’t the case, well, you might as well just start calling the business Cousin Itt.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

You All Do a Good Job

I should have seen it coming…

Prompted by me to tell me that I do a good job, you all responded with a whole lot of emails telling me I do just that. Thank you for making my day. It turns out there is no such thing as too many kind and thoughtful emails. After all, no one puts something out in the world without wanting a genuine response, so good job on that.

Of all of the responses I received, two stuck out for their clarity of thought and so I thought I would pass them along. One, from Casey, said this:

As a people-pleaser, I often catch myself writing “Sorry to clog your inbox” (I’ve maybe even said it to you). As with many things, I’ve settled on it coming down to scarcity versus abundance. If I feel like I’m clogging an inbox because I’m looking for attention or some other ulterior motive, that’s scarcity, and I rethink whether I want to send. If I’m sending because I appreciate what they said or it’s something else genuine, that’s from abundance and I send. Not a hard and fast rule, but it’s been helpful.

Lance, striking a similar tone, said:

I’ve contemplated this a lot and have arrived at erring on the side of over communicating. Email is one dimensional communication so acknowledgment of receipt or saying a quick “Thank you” is affirming and closes the loop.

That last bit in particular resonated with me because one of the most infuriating things that happens in my life these days is when I say something to my kids and they don’t respond. While I’d certainly prefer a positive response, I could handle a negative response, but what’s infuriating is the lack of response. It leaves me wondering if they heard me, care, and what they’re thinking.

C’mon guys!

Because maybe that’s what we’re all reliably looking for in this world: acknowledgment. Have a great weekend.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

How to Test

One of the scarier and more difficult, though unfortunately necessary, parts of operating a business is testing the validity of new ideas. That’s because doing so risks time and capital and can be disruptive to your core business, but also if you don’t do it, your core business risks stultifying and being competed away.

Remember, either you or the world is always moving on.

To that end, we keep a prioritized list of new ideas for each of our businesses and try to be tackling at least one (and ideally the one with the most potential bang for the buck) at all times. The question is how best to do that?

Because I’m the one who keeps a very close eye on our capital stack, I’m generally a fan of incremental testing. This approach is born out of the lean startup/minimum viable product schools of thought, which is to say that if you have a hypothesis about a new initiative, the right way to go after it is to start small, iterate as you go, and feed it with more capital only as it proves itself out.

To that end, our COO Mark is constantly advising our businesses to test new things so long as those tests are (1) measurable and (2) above the water line. What above the water line means is that if the test fails, it’s not catastrophic to the business i.e., punching a hole in the side of a boat is not as bad as punching a hole in the bottom. And if you do find a win, then work on scaling it.

Of course, a catch-22 here is that if you have a big strategic idea and you’re only willing to start small and test incrementally, you may never get around to actually testing that entire big strategic idea. To wit, we have a retail business that is interested in assessing the opportunity of having a brick & mortar location. (And before you say that’s stupid the economics of selling online are way better, a true fact is that building a durable consumer brand requires selling through multiple channels.)

Now, they did the work and identified an ideal spot where we could open a store that would benefit from the right kind of foot traffic, and that could be staffed with people who already knew the brand well and stocked with inventory that could quickly be repurposed if we got indicators that the test wasn’t going well. It was a more significant initial capital outlay than I’d typically greenlight, but when we modeled it out, the returns from getting good data on how to open physical locations was very much worth it.

Unfortunately, the landlord came back and said we couldn’t have that space, but that we could have one that was not entirely dissimilar and also quite a bit cheaper. It wouldn’t benefit from the right kind of foot traffic, but would allow for the risk mitigation pieces on the staffing and inventory side.

As we thought about that, though it was less expensive, we decided that wasn’t a test we wanted to run. The reason was it wasn’t a good location, and if we ran the test and it failed, even if it didn’t cost us much in dollars, the cost of getting a false negative on a big strategic idea might in the long run turn out to be really expensive.

In other words, there is a fine line between the lean startup/minimum viable product/incremental approach and half-assing something. Further, it’s important to know the difference between the two when thinking about how best to test a hypothesis about your business. So in designing any kind of test, resource it sufficiently such that the conclusions you ultimately draw from it are meaningful. That may cost more upfront, but the cost of believing something to be true that isn’t is likely to be significant.

— Tim

Sign up below to get Unqualified Opinions in your inbox.

Still Working on that White Paper

When it comes to thinking about how much capital to put behind an individual investment, one universal truth and three considerations apply. The universal truth is that anything can go to zero, so never invest an amount that if that amount did go to zero, it would prevent you from making additional investments. That specific amount will be different for different actors, but one way to know that you haven’t sized your bets too big is if you always live to fight another day.

And while that advice can help one avoid catastrophic blow-ups (which is something we should all strive to avoid), a bigger challenge when it comes to generating above-average long-term return streams is betting too small. That’s because the more bets you make, the more likely you are to achieve average results, which are then likely to become below average over time due to the increasing frictional costs of trying to keep up with so many bets at once. Ergo the three considerations:

1. How big can this bet get if it goes well?

2. If this bet goes well, what is the net impact on returns if everything else in the portfolio doesn’t go well?

3. If this bet goes poorly, what is the net impact on returns if everything else in the portfolio does fine?

Asking and answering these three questions can help size the opportunity and scope the influence on the rest of the portfolio. The reason that’s important is because you want to be thoughtful about not making investments that are too small to matter, but also avoid making investments that are so big nothing else matters.

For example, one of the smallest investments in our Permanent Equity portfolio is a 3% position. Now, it’s expected to punch above its weight this year and contribute 4% of our total return, but run the numbers and that’s only 73 basis points of that return. So a fair question to ask is: Was it worth it to make and now maintain an investment that contributes less than 1% to our returns and that would still be relatively inconsequential in the scheme of things if it only doubles or triples?

Indeed, we asked that very question at the time we made this investment and our answer was yes because the total addressable market for this business is significant and the operating leverage inherent in the model meaningful, so we thought it had multiples more potential. This doesn’t mean it will achieve that potential, but by virtue of having it, this is a small position size that’s worth it. To put it the context of the considerations:

1. If this bet goes well, it could grow into a 10% to 20% position.

2.As a 10% to 20% position, this bet could be a meaningful positive contributor and make up for one or two bad bets.

3.If this bet goes poorly, it will be a 1% to 2% annual drag on returns.

Now contrast that profile with one of our larger positions, which is 20% of the portfolio and will contribute 30% of this year’s return. We’re happy with that, but don’t necessarily expect the company’s return contribution to grow significantly over time. To put it in the context of the considerations:

1.If this bet goes well, it should remain approximately 20% of the portfolio.

2.As a 20% position, this bet will immediately be a significant contributor to our returns if it goes well.

3.If this bet goes poorly, it will be an 8% to 10% annual drag on returns.

Given that profile, we wanted to take a big enough position now so that the investment would be a material contributor to the portfolio both now and in the future when other companies had grown at higher rates. But in order to take that upfront risk in light of consideration 3, we needed to be compensated for doing so, which we believe we were and are by the valuation we paid and also by being invested via a preferential share class that gives us favorable economics if the business significantly retrenches. So while there is concentration risk, it is mitigated in the near-term by the terms of our investment and in the long-term as our other investing decisions play out.

Having said that, I recognize that none of our investing decisions will play out according to plan. But that’s exactly why we should all try to build a thoughtful portfolio of some number of them sized accordingly.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Tremendous Upside Potential

Prompted on X nee Twitter to share an insult he’d never forget, our founder and CEO Brent told of the time (and he wasn’t making this up) a Deputy CIO at an Ivy League endowment told us they weren’t interested in investing with Permanent Equity because they were “only interested in opportunities with upside.” Having, at that time, recently moved my family to mid-Missouri to take a job at Permanent Equity precisely because I was interested in upside, the comment caught me a little flat-footed.

I think this Deputy CIO’s perspective was that because Permanent Equity invests in companies that do rudimentary things like build fences and then does uncreative things with the profits from those enterprises like distributing them to owners (hello, beer money), our returns were necessarily constrained. And while our approach was and is pretty exciting to me, I guess that is another way of looking at it.

But I was thinking about this whole idea of upside the other day as I watched the machinations in the stock of the newly public Trump Media & Technology Group (Nasdaq: DJT). What a curious situation that is…

In case you haven’t looked under the hood, this is a “business” that former (and perhaps future) President Donald J. Trump (clever ticker!) conceived of to compete with Twitter now X because they kept kicking him off the platform due to things he said that others thought he shouldn’t. But I put “business” in quotes because it’s not much of a business at all. Based on what was filed with the SEC (and let’s go out on a limb and say we can trust that), Trump Media & Technology Group lost $58M last year (though some of that was not beer money) on revenue of just $4M. Further, this “business” believes that “adhering to traditional key performance indicators, such as signups…might not align with the best interests of TMTG or its shareholders.”

Yikes!

Yet a recent market valuation of this “business” was more than $6B. To put that in context, Trump Media & Technology would be by many, many orders of magnitude the worst-performing business in the Permanent Equity portfolio, but by many, many, many, many, many orders of magnitude the most valuable. How does that work?

People are crazy is one answer, and it's not an unreasonable one. Trump Media & Technology is currently a terrible “business.” Not only is it incinerating cash, but its highly-respected audit firm issued a going concern notice (i.e., warning that the company could go bankrupt) at the same time it went public. But another answer is upside. Trump (the former maybe future President) has a lot of supporters and were they to all become loyal, paying sources of recurring revenue for Trump Media & Technology Group in some shape or fashion in the future, that terrible “business” could become a profitable one that delivers unconstrained returns.

But I dunno. $6B seems like an expensive call option on the counterfactual I just described (and people are catching onto this fact with the stock down some 50% since it was at that level).

At this point I’m reminded about the time (and this is dating me like most of my pop culture remembrances do) that ESPN blogger and now Spotify host Bill Simmons called out NBA commentator Hubie Brooks for assigning every unknown basketball prospect in the annual NBA draft with Tremendous Upside Potential. These were players who were not statistically elite, but had characteristics like height or the ability to shoot the lights out when guarded by a chair to maybe one day be. But very few ever panned out.

The point is that upside is not so different from imagination and that imagination is not so different from deception. And that’s the reason why we’re all conned so easily and/or pay up for the prospect of unconstrained returns, because believing something to be true that isn’t yet but could be is exhilarating.

In other words, Trump Media & Technology has Tremendous Upside Potential and probably more than Permanent Equity. But I’m good with Permanent Equity.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

What’s Enough Working Capital?

One negotiation that can get, shall I say, animated as we complete diligence on a deal and finish drafting the purchase agreement is the question of how much working capital needs to be left on a company’s balance sheet at close. The reason that’s so is because the answer to the question “What’s an appropriate amount of working capital for a particular business to have?” is a kind of tautology. The appropriate amount of working capital for a business to have is whatever amount of working capital it is appropriate for that business to have.

In other words, it depends and what it depends on is a wide variety of factors. These include, but are not limited to, what the business is trying to accomplish, whether or not it wants to grow and how much, what time of year it is, what the tenor of the working capital is (i.e., is some portion of the inventory slow-moving or receivables uncollectible), and what it is used to having. And don’t underestimate the importance of that last factor. If a business has historically operated with a lot of working capital and a cash cushion but hypothetically could not (again, most small business owners tend to be financially conservative), it won’t be able to flip a switch and operate well with an optimal level of working capital if it never has. People will behave differently with more financial pressure on them, and that pressure will manifest itself in the numbers.

Further, methodology matters. It’s easy for two parties to agree that they’ll calculate an average over an agreed upon lookback period, but the devil is in the details. If it’s an average, is it a mean or median? What if there is a large standard deviation? Would you handle it differently if it’s a seasonal business and it’s high season or not? Finally, what’s an appropriate lookback period and if it’s long, should you throw out outliers?

Finally, perspective matters (shoutout Miles’ Law). Assuming all parties are being intellectually honest, a buyer of a business wants enough to slightly-more-than-enough working capital to ensure that the business can operate in normal course post-close and won’t require an additional capital injection, whereas a seller wants no more than enough to ensure that they are transitioning a good asset, but also not leaving several hundred thousand dollars (or more) on the table.

Given these slightly-at-odds aims (which can be more than slightly-at-odds if people aren’t being intellectually honest) and all of the ambiguity around the question and calculation, that’s why these negotiations can get animated. So how do we handle that?

First, we show our work. We’ll never put out a number without also showing how it was derived and why. And if you disagree, we ask that you disagree not with our number, but show us where you disagree with our methodology.

Second, we typically won’t specify a number, but a range. We’re not here to nickel-and-dime anyone and hope our partners aren’t either. As long as we land somewhere that’s approximately fair, that’s good enough.

Third, we’re always happy to agree to an after-the-fact true-up to make sure that the amount of working capital a business had at close turned out to be appropriate. Because you only had enough working capital if you ended up having enough working capital.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Working on that White Paper

Back when I wrote about how to build a portfolio, I said that there may be a more in-depth white paper in my future. And while the plan is for that to still be the case, it turns out that trying to write an entire white paper at once is a pretty heavy lift. So in the spirit of turning one difficult-to-achieve big task into a larger number of easier-to-achieve smaller ones, I thought I might take our five tenets of portfolio construction one by one in this space and see what resonates.

As a reminder, if you’re trying to build a portfolio of any individual items that need to cohere to achieve a goal, here’s the checklist:

Know what you’re trying to accomplish.

Don’t risk more than you can afford to lose.

Diversify, but not too much.

Only take risks you’re compensated for taking.

Everything is more correlated than you think.

So if we’re going to take these one by one, let’s first figure out what we’re trying to accomplish. But before I get to hurdle rates and return thresholds, a short story about the u12 girls’ soccer team…

The team got moved up to a higher division this season and is therefore playing some tougher competition. One recent match against a reasonably tough opponent took place on a day when the wind was gusting up to 30 miles per hour. The girls won the coin toss and opted to play the first half with the wind, so the objective in a tie game with the wind at our back was to try to take a commanding lead. To wit, the coach fielded an attacking heavy portfolio of players and the team ended the half with a 3-0 lead.

But now with a commanding lead and facing a stiff headwind, the objective changed. That’s because all the team needed to do to win the match was not concede three goals. So the coach switched out several attacking players and replaced them with defenders in the back. They won the match 3-1.

Yet at the end of the match, some parents were frustrated. They wanted to know why their player had been subbed out when the first half had been so successful and cited as evidence the fact that the team lost the second half 1-0. And that’s one way to look at it. But the fact of the matter is that winning the second half wasn’t the objective. Rather, the objective was not to lose the second half 3-0 or worse, and while a more attacking-oriented line-up might have won the second-half outright, it would also have been much more likely to concede three goals. The defensive line-up, on the other hand, was unlikely to score any goals, but almost assuredly would not concede three or more.

In other words, in building a portfolio, objectives matter. And never try to accomplish more than you are trying to accomplish because in doing so you expose yourself to asymmetric risk. To use the soccer analogy, the incremental gain of winning the match 6-0 is not worth risking the catastrophic loss of turning a 3-0 lead into a 3-3 tie or a 3-4 defeat.

With regards to the definition of investing (“expend money with the expectation of achieving a profit”), knowing your objective means defining how much money you will invest and what the cost of that capital is in order to determine your investment’s capacity and required rate of return. Typically, those two things – capacity and rate of return – are inversely correlated. In other words, you are unlikely to find a strategy that can reasonably invest $1 trillion and double your money in a year, so it would be a bad idea to raise that much capital and bank on those returns.

If you’re investing your own money, your required rate of return should be equal to the return you could get taking little-to-no risk at all (i.e., US treasury rates) plus extra return commensurate with the risks you are taking. These risks can take many forms, but are academically calculated using proxies for traits such as volatility, creditworthiness, size, governance, liquidity, and more, which all try to layer in required return in recognition of the fact that a small, volatile, and poorly-managed private company is generally less likely to pay you back than a large, stable, well-run public one.

If you’re investing other people’s money (as we do at Permanent Equity), then those other people have likely calculated their own required rate of return and agreed to pay you only if you exceed it, so it’s pretty easy in this case to figure out what your minimum required rate of return is. In our case, we take no management fees of any kind and don’t get paid carry until our investors have earned a hurdle rate on their invested capital. We then receive a catch-up until we have earned our share and then split everything after that at a pre-agreed-upon percentage.

So one way of looking at that is that we shouldn’t get out of bed for any return less than what would pay us for our work, and that is indeed one way we look at it. Our objective writ large is to earn a return over time that more than reasonably compensates our investors and us.

Of course, achieving that is more nuanced than investing 100% in things that are expected to achieve that hurdle rate-plus because rarely do individual investments perform like they are projected to (some do better, others worse). So typically we try to underwrite things that will perform well in excess of that number in the expectation that we will be quite wrong every once in a while. Further, we demand higher returns from newer investments that are likely to correlate with existing investments because again there are diminishing returns from turning a 3-0 lead into a 6-0 win versus a 3-4 defeat.

If, on the other hand, you’re anything from an individual trying to retire to an endowment trying to fund a cause, establishing your objective means defining how much money you need to have at some point in the future and then working backwards to determine how much you have now and then calculating the sliding scale between the return you have to earn compared to the amount of money you need to regularly add to the portfolio in order to have that amount of money at that future time. If you are good at saving (if an individual) or raising (if an endowment) money, then your returns can be lower. If you’re not, they have to be higher.

Either way, if you have an objective and know what it takes to get there, it limits the scope of what’s possible and therefore increases the probability you can achieve it. And also, perhaps more importantly, prevents you from ever trying to accomplish more than you need to.

Have a great weekend.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Numbers Tell Stories

At the risk of sounding like too much of a nerd, my favorite financial statement is the balance sheet. That’s because while the income statement and statement of cash flows are useful in showing what may have happened at a business during any given period, the balance sheet is what tells you how a business is positioned for what might happen next (which can also reveal a lot of context about what previously happened). And that’s interesting.

What’s further interesting, and what tells you a lot about the state of the business, is when you can discern whether or not that positioning was proactive i.e., it was something the operator of the business deliberately did or reactive, i.e., it was something the operator of the business had to do because of outside circumstances. Here’s an example…

We saw some numbers from a construction business recently that purported to have made about $3M on $20M of revenue over the past year. Not bad!

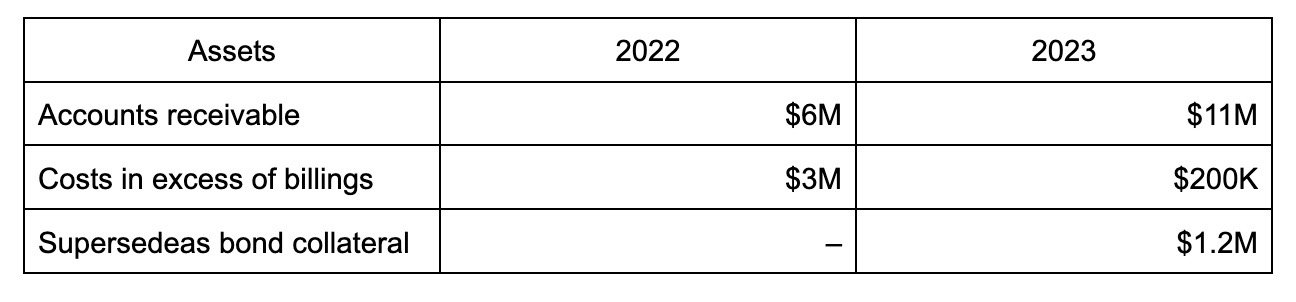

But the balance sheet told a different story. Here’s an excerpt from the asset side:

And the liabilities:

So despite “earning” $3M, here are some things that appear to be true based on how the construction business is currently positioned, as shown by its balance sheet:

Customers have stopped paying it in a timely manner (AR increase).

It’s gone from being underbilled to overbilled (i.e., it’s trying to get paid for work it hasn’t done yet).

It had to post more than $1M of collateral to its bonding company (presumably because there’s a job out there the bonding company doesn’t think the construction business has the ability to finish).

Its suppliers are demanding to be paid faster (AP decrease)

Its bank called in its line of credit (balance went to zero).

It replaced that low-cost, vanilla debt with millions of dollars of debt in the more ominous category of “other” (which probably carries a higher rate and is covenant heavy).

This, in other words, is a business that has lost agency and has been put in a position by its outside stakeholders to be on the verge of running out of money. If I had to guess what happened, the business had at least one or two major jobs turn bad, but hasn’t recognized those losses on its WIP report (shoutout Procore, it’s good software) yet. In other words, it’s either trying to hide them or is in denial. But, and this is important, the rumor mill most assuredly knows what’s up so people who owe the business money aren’t paying (because they know they may never have to) and the people the business owes money to are demanding to be paid now (in order to get as much out of it as possible before it goes under).

Not great!

Ultimately, business and investing are forward-looking enterprises and the only financial statement that can give you a clue about what’s to come is the balance sheet. Which is why it’s my favorite.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

How to Add Value Post-Close

One thing that I’ve found to be true of most small business owners is that they are fairly financially conservative. That’s because despite being wealthy, most of their net worth is tied up in an asset (the business) that has a lot of people relying on it and is always seemingly a few bad months in a row away from a crisis. So they try to keep costs down and cash in their pockets.

That was the context I gave when I was on a call recently with two gentlemen who wanted to get into the business of acquiring companies and asked me what areas, when we were both underwriting potential investments and helping operate post-close, we could reliably add the most value. And while I said that we typically don’t underwrite to being able to be helpful at all (shoutout margin of safety), we’ve historically been helpful in four areas: hiring (shoutout Kelie), marketing (shoutout Emily), technology (shoutout Johnny), and financials (shoutout Nikki and team).

What’s interesting about these four areas is that they are four areas that a reasonable, but financially conservative, small business owner might view as cost centers. In other words, why pay people to recruit for you when you can do it for free through word of mouth? Or why buy online advertising if you can’t tell how many conversions it drives? Or why get a pricey ERP when a spiral notebook works just fine? And finally why do anything more than file the required tax returns?

Again, each one of these stances makes sense on its face in this context, but without top-notch people, effective marketing, reliable and useful technology, and timely and accurate financials, a business can’t grow. So when Permanent Equity steps in and encourages investment in these areas, while we do hear some grumbling about the cost, we typically get a pretty good return because (1) these areas are important and (2) they have historically not been invested in.

Back when I wrote about brewing the world’s best cup of coffee I mentioned the three paradigms that describe what might lead to success. One is you’re only as strong as your weakest link, i.e. the best you can do is your worst input so always try to raise up your laggards.

In the case of trying to add value to small business operations after making an investment, I think this is the paradigm that best applies. In other words, be useful in an area that’s important but that the previous operator viewed as useless. That’s because nothing (or not much) is likely to have been done in the area before and doing something that’s important is usually reliably better than not doing that something important at all.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Day 2

At Amazon it’s supposed to always be Day 1. What this means is that anything is possible if you stay “constantly curious, nimble, and experimental.”

As for day 2, well, that’s what you want to avoid. Because as founder and then CEO Jeff Bezos joked at an all-hands meeting, day 2 “is stasis followed by irrelevance followed by excruciating painful decline followed by death.” And as someone who sits here 40-plus years old with acute tennis elbow after getting smoked in a casual game of pickleball, that hits a little too close to home. But does day 2 get a bad rap?

I thought about this recently when my daughter got a new phone. See, before she traded in her old phone, she made sure to transfer all of the photos on it that she wanted to keep. I was looking at those pictures with her as she did this and among them were her as a 3- and 4- and 5-year-old playing soccer with me coaching in the background. I about cried (which is becoming a recurring theme here) reliving those moments.

One takeaway from that is that sentimentality increases exponentially with age. Another, since she wanted to save them, is that teenagers may actually care about stuff (though the jury is still out on that)...

But she was offended when I remarked that I missed those days. Because why would I miss those days when I have these days? And that was an interesting question because I love these days. What’s different from then to now, though, is (1) we have fewer days left and so therefore (2) there is less open-ended-ness.

In other words, and to be brutally honest, even though I try to be curious, nimble, and experimental, it’s not day 1 for me anymore (and also not for Amazon either). I’ve done things and made decisions that specifically preclude me from doing other things and making other decisions which means that not anything is possible for me. That said, it oversimplifies it (I hope) to say that if I’m on to day 2 (or 3 or 4) with a diminished opportunity set that I’m headed for irrelevance and excruciating painful decline.

That’s because here on day 2 (or 3 or 4) I’m building on previous choices made to take a step (or steps) forward. So while my scope of opportunity is narrowing, the magnitude of significance of what’s left to do is growing.

When I previously about cried prior to spring break, I wrote that you or the world is always moving on, and I stand by that. But the thing about that statement is that it’s simultaneously something to be lamented and celebrated. To wit, I miss my little kids, but I love my kids.

So the thing to avoid isn’t day 2 because day 2 (or 3 or 4) is inevitable. The thing to avoid, as Bezos rightly notes, is stasis.

So wherever you are, personally or professionally, recognize that you won’t be there for long and further that you can’t (and hopefully don’t want to) go back to where you once were. You’re headed somewhere next and that also means not being headed to an increasing number of other places. For that to be something to celebrate and not lament, be intentional with your investments of – and in – time, capital, opportunities, and people. You can’t do it all, but do what you can.

Here’s to Day 2.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

These Are Still Worth Reading

Felix shot me a note not long ago asking if I had to train myself in investing today, what books would I read? This, of course, revealed Felix as a relatively recent reader since I touched on this topic way back in season one. But since most of you are relatively recent readers (building an audience is a slow burn) and since Felix asked, I thought I’d revisit it.

First, a point about investing. For me, successful investing requires taking insufficient information and synthesizing it with what you know about the world to make bets on people that are more likely than not to increase in value at a rate that exceeds what you’d achieve by getting out of bed everyday and going through the motions. If you agree, then investing methodologies aren’t necessarily what matters most to doing it (though you do need to be numerate and know enough about financing and accounting to be dangerous), but rather knowledge and understanding of how both you and others are wired and the implications of that for how the world works. This is why my book recommendations for aspiring investors are pretty unconventional. They are: The Classic Guide to Better Writing by Rudolf Flesch, Deep Survival by Laurence Gonzales, and A Sick Day for Amos McGee (a children’s book!) by Philip C. Stead.

A good question is why are these three odd books my recommendations? The reason is that together they can help you understand and communicate well in stressful situations with incomplete information while remaining kind, caring, and curious. And there you have it. That’s investing.

Yet another aspect to successful investing is that you have to be constantly updating your priors (shoutout Thomas Bayes). To that end, I also recommend investors read a lot of contemporaneous stuff every day. These picks include X nee Twitter, Matt Levine’s Money Stuff, The Wall Street Journal, newspapers from different foreign cities, recent SEC enforcement actions, and newly published papers in the field of decision science.

Yet if you twist my arm, you can also get me to recommend some canonical investing and business books. None of these are likely anything you haven’t already heard of, but if you know someone who hasn’t read them and wants to get into this field, they always make great gifts. They are (in no particular order):

The Intelligent Investor by Benjamin Graham

Poor Charlie’s Almanack by Charlie Munger and edited by Peter Kaufman

Berkshire Hathaway Letters to Shareholders by Warren Buffett

The House of Morgan by Ron Chernow

The Fish that Ate the Whale by Rich Cohen

Business Adventures by John Brooks

The Big Short by Michael Lewis

The Match King by Frank Partnoy

Shoe Dog by Phil Knight

Expectations Investing by Michael Mauboussin

Unreasonable Hospitality by Will Guidara

Thinking, Fast and Slow by Daniel Kahneman

What’d I miss?

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Do you Care to Be Curious?

I grew up in New York, but spent the most formative years of my life (17 to 37) in Washington, DC. In other words, I landed there a kid out of high school and left a home-owning parent. I’m not sure what gets more formative than that.

Anyway, I had the opportunity to travel back there recently, and that prompted some reflection. I saw some places I’d taken my kids way back when that were completely the same and then some others that were completely different. What’s true is that either you or the world is always moving on.

But rather than make this a big piece about big things like that, I’m going to make it a small piece about me (my favorite topic!) and about the compliment I got from my friend and mentor Bill Mann when we went to visit and have dinner with him at his new pub in Vienna, VA (shoutout Hawk & Griffin…get the fish & chips).

First of all, I love Bill and the fact that he now owns a pub. We should all aspire to be a part of a neighborhood gathering place we adore, and the fact that he hosts a quiz night there every Wednesday made me envious (the only person that might take him down should they compete in that venue is my son, the 3x GeoBee champion).

But as Bill was treating us to fish & chips Emily (who else?) asked him to tell some embarrassing stories about me. Bill demurred (despite many obvious candidates) and so Emily, switching gears, asked if he ever thought this kid from NY via DC would ever find himself in mid-MO doing a prescribed burn of a native wildflower meadow (which is something I do annually because when we moved to Missouri, we moved to Missouri)?

Then Bill, after ruing the fact that he still hasn’t traveled out to help (shoutout Clayton and James who do, though admittedly they live here), said, “I didn’t know where this kid was going to end up, but ever since I’ve known him he has cared about knowing how things work and dove into finding out. So does it surprise me that he is now doing a burn in Missouri? No.”

I about cried. It was one of the nicest things I’ve ever heard said about me.

Now, this whatever-it-is is not supposed to be about me, but since I write it, it tends to traffic in ideas I’ve learned or observed over time. One of those that I put forth a while back is that we should all care enough to be curious.

But it’s one thing to write something and another to live it, so the reason I so greatly appreciated Bill’s comment is because it confirmed that someone saw in me something I aspire to be (which is to care and be curious). And that feels good.

What are the takeaways?

One is to make sure you’re doing things that you care enough about to be curious about and therefore really dive into doing them. This means you avoid the dreaded going through the motions and ensures you will have fun while also achieving at a high level, which is something others will notice.

Another is to tell people what you see in them, and particularly so if it’s good, because it will never go unappreciated. Self-assessment is hard and imposter syndrome is a real thing we all deal with. This isn’t to say that we’re phonies (as Holden Caulfield would allege), but rather that it’s hard to be and know that you are who you want to be. But if you try to be it genuinely and consistently, the world should and will see it in time and eventually.

Finally, while this is normally where I’d say have a great weekend on this flippant Friday, it’s Spring Break! We have some plans and so therefore plan to take a few weeks off to recharge. See you on the flip side, have a great time in the meantime, and we (mostly SarahGW) promise to finish S3 (huh?), whenever it is that we come back, strong.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Drinking to Add Value

One observation that we made recently is that when we travel as a team, we have significantly more productive experiences when we share an Airbnb instead of having individual hotel rooms. The reason for that is that when we get an Airbnb we usually spend an hour or so in the common space after dinner discussing the day while it is still fresh on our minds. When we get hotel rooms, on the other hand, we tend to retire to our rooms after dinner.

In both circumstances, whether we are out in the field on a site visit for a potential deal or meeting with one of our portfolio companies, there is usually a lot to reflect on. And this isn’t to say that we do that when we get an Airbnb and don’t do it when we get hotel rooms, but rather than when we get an Airbnb, it’s a social activity and a dialogue whereas when we get hotel rooms, it’s an antisocial one and a monologue (because we draft written notes and pass them around via email or Slack).

Both of these approaches have their place, but a key learning is that we need to do both.

Back when I wrote about my process for writing Unqualified Opinions every day, I noted that that process has two phases. The first, an idea generating discovery phase with my son, is conversational and social while the second, an editing and refining phase that I do in my head while I run, is isolated and antisocial. Then I said that that makes sense because good ideas need both points of view and a point of view and added offhandedly that meetings should be organized that way as well.

More than a few people latched onto that offhand comment, with one person saying he would spend the next few days thinking about how his meetings might better employ both phases. I asked him to tell me what he figured out because to the point about Airbnbs versus hotel rooms, we haven’t hit upon a reliable, repeatable process either.

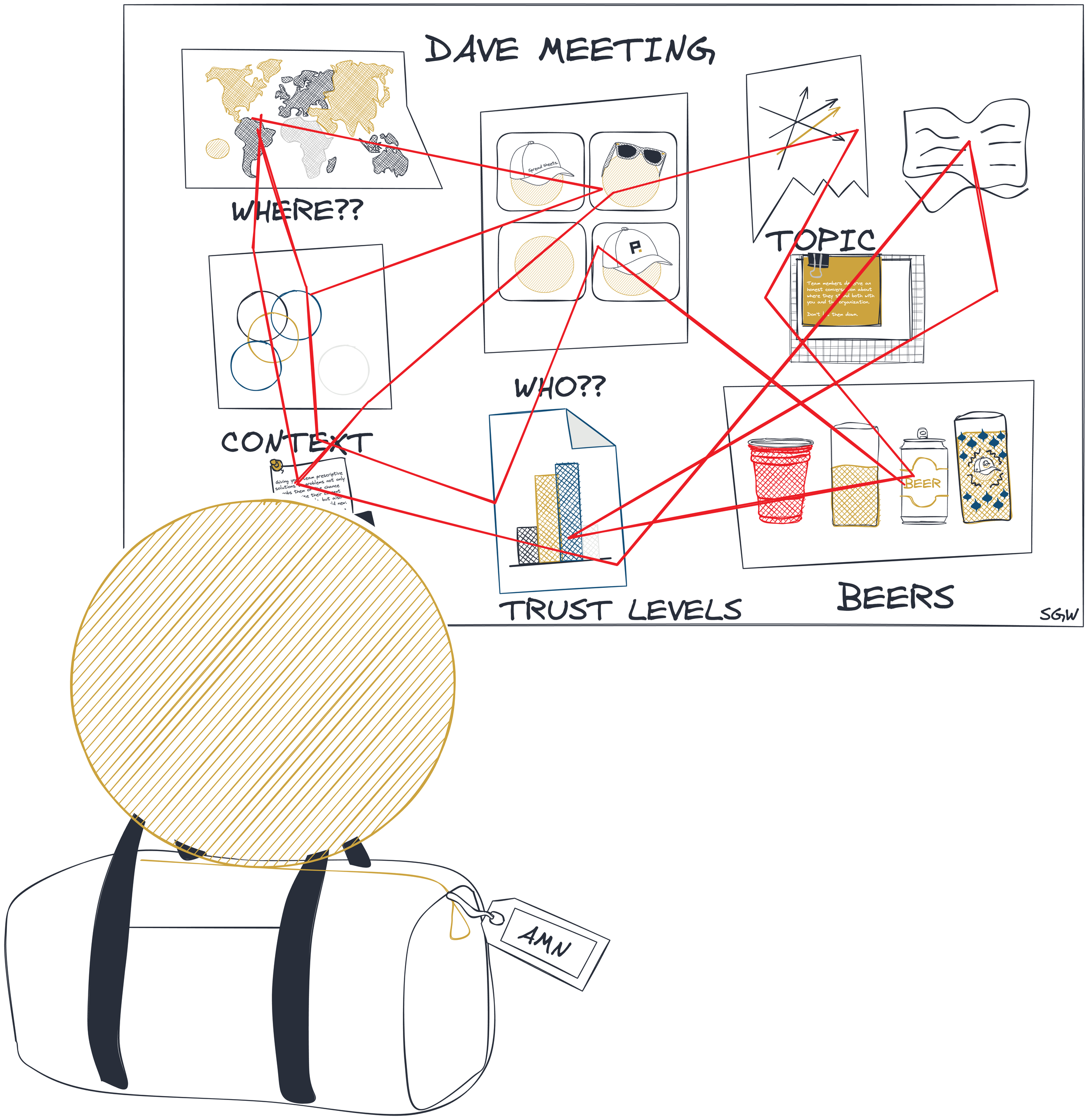

To wit, after one particularly productive conversation we had on the road recently, Mark said to the group, “I thought this conversation was particularly productive. How do we have more of them?” As we thought about that, we tried to identify the factors that contributed to that productive conversation. Here’s what we came up with:

A group that wasn’t too big, but wasn’t too small;

That had high levels of trust;

But different levels of context;

On a topic that was both recent and timely;

With nowhere to go and nothing else to do;

After having a few beers.

And when we looked at that, it seemed like a difficult set of variables to formalize without locking people in the office and forcing them to drink on short notice – which doesn’t seem like it would be productive and/or good for work/life balance.

But apparently our COO Mark is going to give it a shot, planning to schedule the first optional Permanent Equity Drinking to Add ValuE (DAVE) meeting for later this month. We’ll see how it goes.

-Tim

Sign up below to get Unqualified Opinions in your inbox.

Time to Judgment

Something we struggle with over and over again at Permanent Equity is how long to wait and watch before declaring that something is going well or poorly. And then, relative to that, how strong to push to adapt to this new and unexpected set of circumstances.

I mention this now because it’s timely. We are almost three months – or one quarter – of the way through the year, which means there is two-plus months of financial and performance data from our portfolio companies to analyze and react to. If one of them is struggling to date, should we be concerned and, if so, how concerned should we be? If, on the other hand, another is outperforming, is now the time to celebrate?

In my experience, the answers to these questions depend on three variables: time, magnitude, and trust.

For example, I had the misfortune this past season to have a rooting interest in two of the most disappointing men’s college basketball teams in America: the Missouri Tigers and the Georgetown Hoyas. Missouri, you may remember, wildly outperformed expectations last year in Coach Dennis Gates’ first and made the NCAA tournament only to run it back and go winless in SEC play in 2023-24. The Hoyas, on the other hand, parted ways with alumnus Patrick Ewing to bring in the much-heralded coach Ed Cooley from Providence only to win two games in the Big East, both over lowly DePaul.

And while it would have been inconceivable for anyone to think Dennis Gates would be on the hot seat this time last year, the magnitude of the team’s recent underperformance means that there is chatter about his job security despite his only being in the role a short time and having previously built up a lot of trust. Ed Cooley, on the other hand, still has a lot of trust given his long-term track record, but if next year isn’t better than this past one in terms of wins and losses and recruits, his seat is going to heat up as well.

Look, we can all agree that bad days happen and that they are outside of our control. Bad weeks, too. But a bad month? A bad quarter? A bad year or two?

In the case of our businesses, we see a lot of bad months, and they tend to be more noise than signal. That, I think, is common in the lower middle market. After all, it’s impractical for businesses of such a size to have the attributes, such as hedging programs, employee redundancies, and revenue visibility, that underpin stable month-to-month performance.

But bad quarters, while not necessarily anything to panic about, more times than not put the nail in the coffin of the prospect of a truly great year. And if you have two bad years in a row that, more times than not, means that something is broken and needs fixing.

Yet a lot of time (21 months to be exact) elapses between a bad quarter and a bad two years, so we’re back to the question of when to intercede and how forcefully? Because change, if it’s real change, is destabilizing, and it might have the same (or better) odds of making things worse as it does to make them better.

Let’s go back to Dennis Gates. Sure, Missouri could replace him, but he by all accounts has put together a top 10 2024 recruiting class (watch your head, Annor Boateng). Get rid of him and those kids are likely gone, so Mizzou hoops would be back to square one. In other words, I’d have enough trust to give him more time given that the magnitude of the upside next year would make up for what has been a terrible, terrible one-year measurement period.

But I could also see someone taking the other side of that argument because a year is a long time and because the in-game adjustments haven’t been great. The challenge with a decision like this, of course, is that if you make it one way or the other, you will never know how the other decision would have worked out.

So when and how, in business, in sports, or wherever, do you feel confident about how things are going? Let me know because I’ll take all the help I can get.

Sign up below to get Unqualified Opinions in your inbox.

Bertie’s Beer Money

You’re in rarified air as an investor if you’re able to throw shade at the Financial Accounting Standards Board (FASB), Securities & Exchange Commission (SEC), and your auditor without fear of comeuppance. And that’s where Berkshire Hathaway’s Warren Buffett is these days, doing just that in his most recent annual letter in pointing out the pointlessness of reporting GAAP net income.

I previously wondered who generally accepted generally accepted accounting principles (GAAP), and the fact remains that it’s the least worst way of tracking financial performance except for all the others.

Buffett’s gripe with GAAP has to do with its requirement that Berkshire mark its investment portfolio to current “fair” market values on its balance sheet and therefore book corresponding gains or losses on its income statement depending on whether those market values went up or down. This creates massive volatility, with Berkshire reporting a $23B loss in 2022 compared to $96B of profit in 2023, with little to no impact on the company’s operating cash flow since Buffett has no interest in selling his investments.

For Buffett, these numbers are “worse-than-useless,” and I don’t disagree. So then the question becomes what numbers are useful?

In that same letter, Buffett says that his target audience for his letter is his sister Bertie who is “very sensible” and “understands many accounting terms, but…is not ready for a CPA exam.” And he posits that what she would find useful, at least as a starting point, is operating earnings, which is a measure of business performance that throws out those mark-to-market gains and losses and other line items such as interest expense in order to report on how much money Berkshire’s companies are making by opening for business every day.

And while those earnings are more consistent and do a better job of giving someone like Bertie a sense of Berkshire’s viability, I would posit that they are also not that useful in evaluating Berkshire as an enterprise. After all, making successful investments is a huge part of Berkshire’s value proposition, and those investments account for almost half of the company’s $800B balance sheet. To not bother reporting on how they’re doing seems like an oversight and also how they’re doing seems like something Bertie would want to know! Further, Berkshire doesn’t look as good as an investment through the operating earnings lens (trading at 25 times) as it does when one takes the entire balance sheet into account (trading at 1.5 times book value).

The point is numbers, no matter how you slice and dice them, will always be deceiving. Even my hallowed beer money metric falls down when it comes to evaluating Berkshire – after all of its investments, capital expenditures, and payments on debt, the company added just (relatively speaking) $2.2B of cash to its balance sheet in 2023 (sorry, Bertie). But of course much of that reinvestment was discretionary, i.e., it could have been beer money instead. And given Berkshire’s investing track record, foregoing beer money now should mean more beer money in the future.

So where does that leave us? Well, if numbers can always be deceiving, then the only thing we can do is to try to work with people who won’t use them that way. Because what’s the point of beer money if you don’t want to have a beer with the people you earned it with? Cheers.

P.S. Danny didn’t get a glass.

-Tim